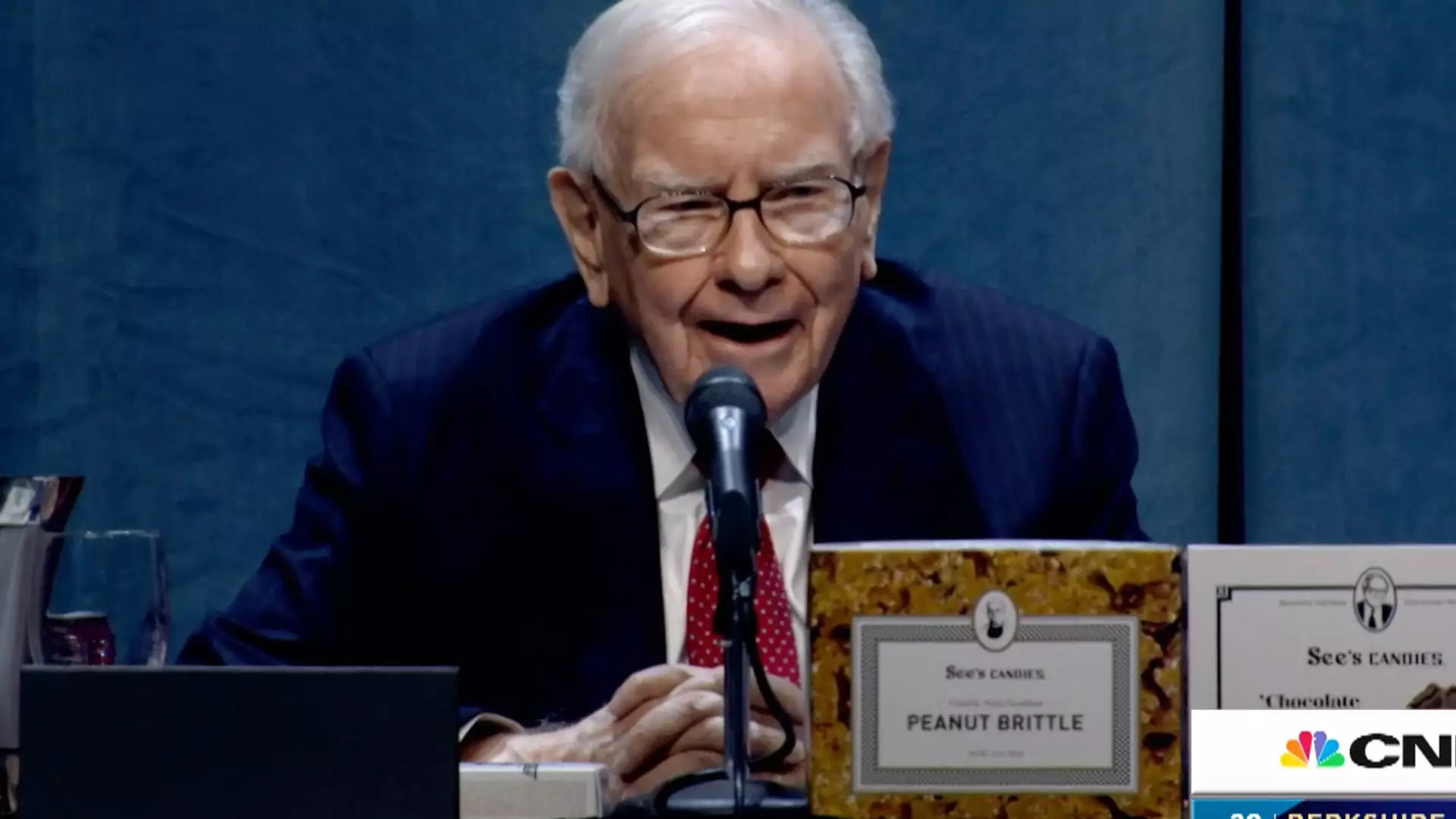

Warren Buffett, one of the most esteemed investors in the world, recently shared his thoughts on President Donald Trump’s tariffs—remarks that come as a rarity from the typically reserved investment mogul. In a conversation featured in a CBS documentary about Katharine Graham, the late publisher of the Washington Post, Buffett referred to tariffs as a form of economic warfare, asserting that they could incite inflation and ultimately burden consumers. His assertion that tariffs are akin to taxes emphasizes the broader implications these financial policies carry for the economy.

Buffett’s experience, leading the conglomerate Berkshire Hathaway—which spans multiple industries including insurance, energy, and manufacturing—provides him with a unique perspective on how these punitive duties affect market dynamics and consumer behavior. He humorously pointed out, “The Tooth Fairy doesn’t pay ’em,” highlighting that the costs of tariffs inevitably trickle down to consumers, who must shoulder higher prices for imported goods. This insight digs deeper into the adverse effects of such trade measures, particularly questioning the long-term economic consequences associated with them.

The Timing and Context of Buffett’s Remarks

Buffett’s comments arrive against the backdrop of Trump announcing significant tariffs, specifically a 25% duty on imports from both Mexico and Canada and an additional 10% on Chinese goods. This escalation has triggered a wave of concerns among investors and economic analysts about potential retaliatory measures from affected nations. The intricate dance of international trade and tariffs can create a fog of uncertainty—a reality that Buffett has voiced keenly in prior discussions during Trump’s presidency.

While Buffett has always maintained a cautious stance regarding trade conflicts, his reservation to comment directly on the current economic landscape speaks volumes. His refusal to engage further on this topic could indicate a careful calibration of his public persona as he navigates potential market instability. This protective tact is complemented by his recent strategies of divesting from stocks and amassing cash reserves, prompting interpretations that range from defensive positioning to preparations for succession at Berkshire Hathaway.

Market Volatility and Future Considerations

As volatility in the market intensifies amid global economic unpredictability, Buffett’s guarded approach serves as a lurking signal to investors. The S&P 500 has seen stagnant growth, merely inching up about 1% this year—a sign that broader economic conditions may be in flux. Investors and stakeholders are acutely aware of the potential repercussions of Trump’s policies on global markets, and Buffett’s established track record prompts many to regard his actions as a barometer for future economic climates.

To encapsulate Buffett’s recent commentary on tariffs is to recognize a profound concern for the long-term health of the American economy. Tariffs—far from being a simple policy decision—embody a complex interplay of market forces that affects millions of consumers. The potential inflationary effects and increased costs brought on by tariffs can reverberate across the economy, reminding us that economic policies must carefully consider their downstream impacts to safeguard the interests of all stakeholders involved. As we watch these developments unfold, the critical voice of seasoned investors like Buffett will undoubtedly remain a cornerstone of economic discourse.