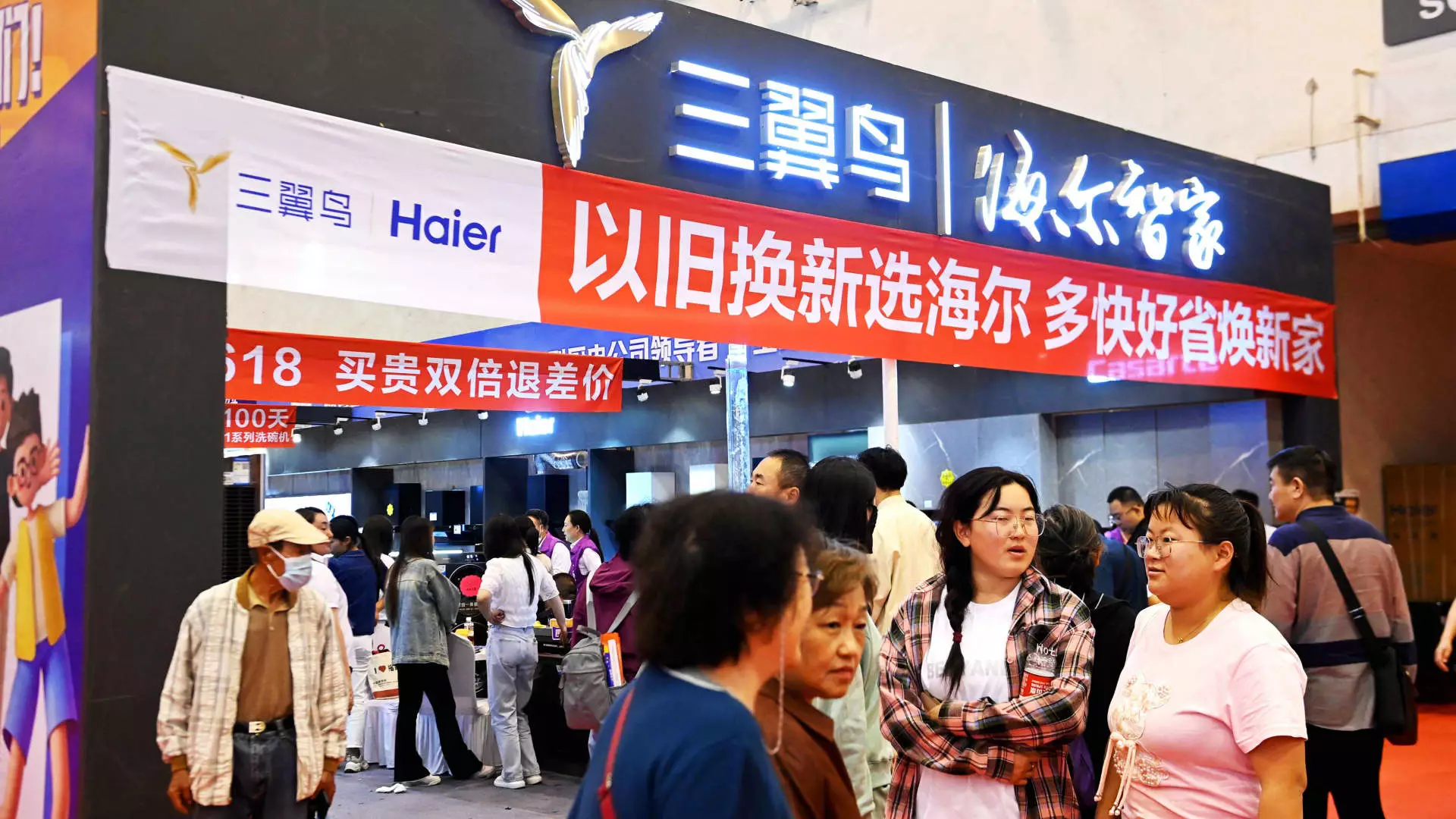

China’s initiative to spur consumer spending through an expansive trade-in program reflects its ambitious strategy to rejuvenate its economy. Announced in July, the Chinese government allocated a staggering 300 billion yuan (approximately $41.5 billion) in ultra-long government bonds aimed at enhancing existing trade-in policies and facilitating equipment upgrades. The plan earmarks half of this budget for supporting trade-ins of substantial consumer goods like vehicles and appliances, while the remaining funds focus on upgrading large machinery, including elevators. Although the government’s intentions appear strong, the on-ground effects of this strategy have yet to materialize significantly.

The endeavor comes at a crucial time when China’s retail landscape is under considerable pressure. With varying levels of success in boosting consumer sentiment and purchasing power, local businesses express skepticism regarding the immediate efficacy of the trade-in policies. As Jens Eskelund, president of the EU Chamber of Commerce in China, points out, there is a lack of concrete evidence suggesting that these measures have successfully transformed into measurable incentives for consumers. The Chamber’s analysis emphasizes that on average, the government’s subsidy translates to about 210 yuan (or $29.50) per person, raising doubts about its potential to notably drive up domestic consumption.

Despite the good intentions behind the policy, there’s an underlying issue: the cautious nature of Chinese consumers. For the trade-in program to be successful, consumers must initially spend out of pocket and possess a used item they wish to trade. The hesitance to spend, influenced by uncertainties in economic stability, has limited the reach of these initiatives. Analysts remain pessimistic about the measurable impact this program can have on retail sales, predicting that it may account for only about 0.3% of retail growth in 2023.

Examining recent retail data offers a sobering view. For instance, retail sales in June showed a minimal increase of 2%, marking the slowest growth since the COVID-19 pandemic. This slight uptick was followed by a modest rise of 2.7% in July, overshadowed by the significant surge in new energy vehicle sales, which increased by nearly 37% during the same month. This discrepancy highlights the challenges the traditional retail sector faces, even as certain segments thrive.

In addition to consumer apprehension, the program’s operational groundwork appears to be lacking. The vertical market for large equipment, particularly in sectors like elevators, presents a challenge of clarity and urgency. Significant elevator manufacturers have reported that they have yet to see a meaningful inflow of new orders resulting from the directives associated with the trade-in plans. Otis, a U.S.-based elevator company, mentioned that clarity regarding the allocation of the funding remains ambiguous, thereby impairing immediate decision-making for businesses.

Furthermore, both local government officials and businesses express a shared concern regarding the effective deployment of these subsidies. Local initiative is crucial, as the specifics of how the funds can be utilized often vary by municipality. Some regions are just beginning to unveil how the trade-in policies will unfold, which can further delay the benefits of the planned initiatives.

Looking Ahead: Hope and Skepticism

While there are clear opportunities within this trade-in framework, the path forward is filled with uncertainties. For companies like Kone, a Finnish elevator manufacturer, the crux lies in the long-term potential these policies could unlock. They recognize the energy-efficient advantages new elevators possess over older models, suggesting that, while the present circumstances are challenging, they remain optimistic about future market conditions.

On a related note, businesses operating in the secondhand market, such as ATRenew, are viewing the ultra-long government bonds as a supportive structure for future growth. The initial impact of the trade-in policy may not yield immediate dividends, but they hope this approach fosters a more robust secondhand goods ecosystem.

While the road to enhanced consumption through trade-ins may be long and winding, it is vital for stakeholders—ranging from local governments to businesses—to leverage this moment, ensuring that they not only capitalize on the intended benefits but also address consumer concerns effectively. The success of China’s trade-in program ultimately rides on a collective effort to foster confidence within the consumer base while simultaneously delivering measurable results that can invigorate the economy.