In the intricate realm of monetary policy, deviation from consensus is a rare but consequential act. The recent dissent by newly-appointed Federal Reserve Governor Stephen Miran stands out as a bold assertion against the prevailing cautious stance of the Fed. While most members leaned towards a modest quarter-point rate cut, Miran’s call for a half-point reduction signals a paradigmatic shift — or at least a serious attempt to reshape expectations. This dissent is emblematic of an underlying fissure within the Federal Reserve’s decision-making process, revealing tensions between cautious guidance and aggressive economic stimulus.

The Significance of a Dissenting Voice

In the context of the Federal Open Market Committee (FOMC), dissent can serve as a mirror to the complex landscape of economic outlooks and policy priorities. Miran’s decisive call for a steeper rate cut underscores a conviction that conventional approaches may no longer suffice. The fact that Miran was confirmed just days prior, with his stance already diverging from that of senior members like Michelle Bowman and Christopher Waller, signifies a potential rift in the Fed’s collective mindset. While the majority appears content with easing rates gradually, Miran signals that the economy may require a more assertive approach.

This divergence also speaks to the broader political influence shaping monetary policy debates. Miran’s appointment and his openness about aggressive rate cuts—aligned with President Donald Trump’s public stance—highlight the intersection between politics and economic policymaking. It raises questions about whether the Fed’s independence is truly intact or whether political pressures are subtly nudging the central bank towards more dovish or even provocative actions.

The Political and Economic Implications

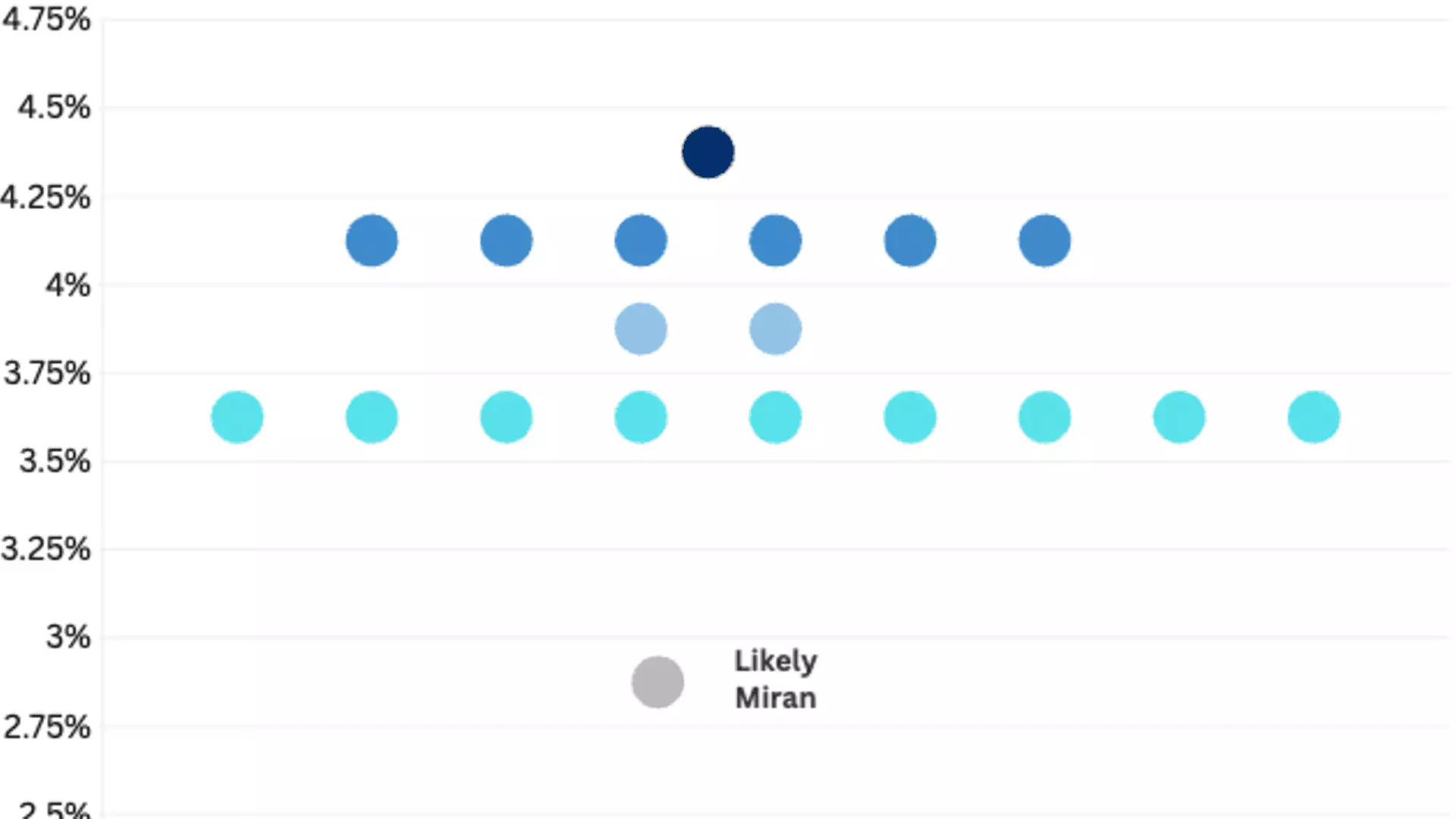

The influence of political figures on the Fed is a double-edged sword. On one hand, the appointment process ensures accountability; on the other, it risks politicizing decisions that should remain insulated. Miran’s advocacy for significantly lower rates, possibly as low as two to three percentage points below current levels, suggests a willingness to align monetary policy more closely with political preferences. Although the Fed’s dot plot depicts considerable disagreement about the trajectory of rate cuts in 2026, Miran’s stance pushes the envelope, hinting at a more expansive easing cycle.

This stance could have profound effects on markets and economic stability. A more aggressive easing could stimulate growth and employment but might also stoke inflation or asset bubbles if not cautiously managed. Markets often react strongly to such dissenting voices, potentially destabilizing expectations or prematurely pricing in rate cuts that aren’t yet justified by the macroeconomic data.

The Broader Context of Federal Reserve Politics

Miran’s appointment and his outspoken dissent come amid ongoing political turbulence affecting the Fed’s independence. Critics argue that President Trump’s influence through nominations might tilt the institution toward policy decisions favoring immediate political gains rather than long-term economic stability. The controversy surrounding the firing of Federal Reserve Board member Lisa Cook exemplifies this tension. Miran’s dual role as a White House Advisor and a Fed governor complicates this landscape further, blurring the lines between political ambitions and economic expertise.

Furthermore, Miran’s position reflects a broader trend: an increased willingness among some policymakers to challenge the consensus, even if it means risking internal discord. Whether this will lead to meaningful shifts in monetary policy or merely serve as a political spectacle remains to be seen. What’s undeniable is that the coming months will be critical in determining if dissent can influence the Fed’s trajectory or if it remains a symbolic act amid a prevailing consensus.

Miran’s dissent signals more than just a disagreement over the size of a rate cut; it embodies a deeper question about the direction of monetary policy amidst a shifting political landscape. His willingness to advocate for more aggressive easing reflects a confidence that the economy may need stronger support and a challenge to the cautious stance espoused by others. As the Fed navigates a complex environment marred by political overtones, markets and policymakers alike will need to grapple with the implications of having a dissenting voice that dares to push the boundaries of conventional wisdom. This push-and-pull between consensus and dissent could redefine the future of monetary policy—if not immediately, then in the very near future.