The recent Chinese Consumer Price Index (CPI) and Producer Price Index (PPI) data have shown mixed results, with the CPI rising at a slower pace than expected and the PPI declining more than forecasted. This has led to minimal impact on the AUD/USD pair, with buyers seemingly unaffected by the softer-than-expected inflation data from China. The relationship between Chinese economic indicators and the value of the Australian Dollar is crucial due to China being Australia’s largest trading partner.

The Reserve Bank of Australia plays a significant role in influencing the Australian Dollar through its monetary policy decisions, particularly the setting of interest rates. The level of interest rates established by the RBA affects the overall economic conditions in Australia, which in turn impacts the value of the AUD. The RBA aims to maintain a stable inflation rate by adjusting interest rates accordingly, with higher interest rates generally supporting the AUD and vice versa.

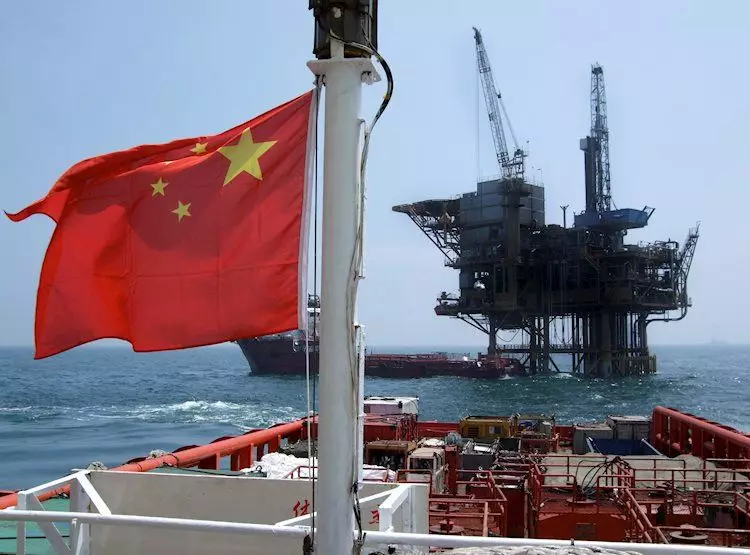

The health of the Chinese economy directly influences the demand for Australian exports, especially commodities like Iron Ore. As China is the primary destination for Australian Iron Ore, any changes in Chinese economic growth can have a direct impact on the value of the Australian Dollar. Positive growth in China leads to increased demand for Australian goods, boosting the AUD, while a slowdown in Chinese growth can have the opposite effect.

Trade Balance and Export Demand

Australia’s Trade Balance, which reflects the difference between exports and imports, is another factor affecting the value of the Australian Dollar. A positive Trade Balance, where exports exceed imports, indicates strong demand for Australian goods and services. This surplus demand contributes to the strengthening of the AUD, while a negative Trade Balance can weaken the currency. Factors such as the price of Iron Ore and the overall demand for Australian exports play a crucial role in determining the Trade Balance and, consequently, the value of the AUD.

The Australian Dollar is influenced by a combination of domestic economic factors, such as RBA policies and inflation rates, as well as external factors like Chinese economic indicators and global commodity prices. Understanding the intricate relationship between these variables is essential for traders and investors looking to forecast and interpret movements in the value of the Australian Dollar. By staying informed about key economic data releases and market trends, stakeholders can make more informed decisions when trading the AUD.