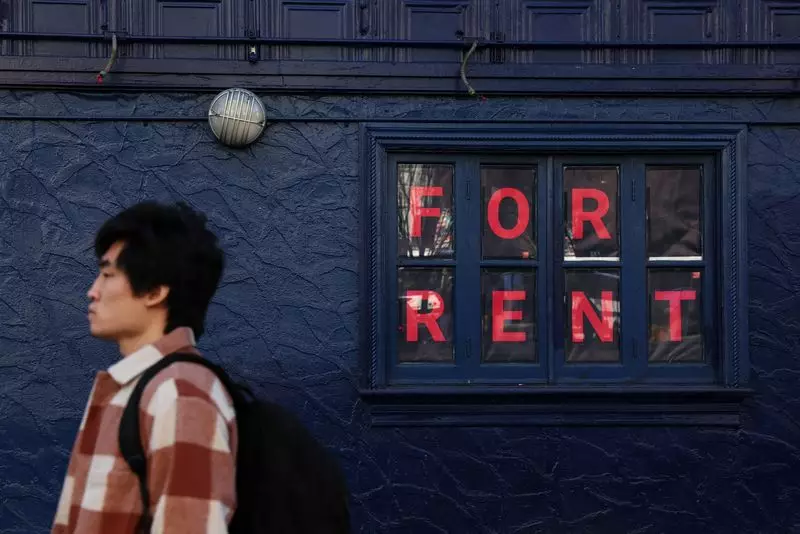

The persistent rise in rental prices has become a hot topic within economic discussions, especially concerning consumer spending power and overall inflation rates. A recent report from the Federal Reserve Bank of Cleveland has illuminated the ongoing issue of rent inflation, predicting that it will remain elevated well into 2026. Understanding the implications of sustained rent inflation is essential for policymakers, consumers, and economists alike as they navigate the post-pandemic recovery landscape.

The Cleveland Fed’s analysis indicates that the Consumer Price Index (CPI) for rental inflation will likely hover above the pre-pandemic norm of 3.5% until at least mid-2026. This forecast reflects an inherently complex economic environment where adjustments in rental prices are not immediate and may take considerable time to stabilize. One of the central issues identified by the Fed is the significant disparity between new rental agreements and existing rental prices. This gap creates pressure on ongoing lease agreements, suggesting that tenants may face increasing rental costs as the market adjusts.

According to the report, the estimated rent gap in September 2024 will be around 5.5%, indicating a substantial delay in price adjustments for existing leases. This finding has profound implications, as it suggests that many consumers may continue to face mounting rental costs, ultimately affecting their disposable income and spending behavior.

The ramifications of persistent rent inflation extend beyond individual consumers to influence broader economic indicators. Central bankers have expressed concerns that sustaining higher rental costs could complicate efforts to lower overall inflation rates following a post-pandemic surge. The Federal Reserve’s goal to bring inflation back down to a targeted rate of 2% is increasingly jeopardized by the “stickiness” of rent inflation. Reports show that while annualized rent growth is slowing, it remains significantly above the desired rate.

Notably, research from various economists, such as Omair Sharif of Inflation Insights, highlights that rent inflation has shown a deceleration, with figures reflecting a shift from 6.8% earlier in 2023 to 4.6% by September. This trend indicates that while immediate pressures are easing, the long-term outlook remains fraught with uncertainty, particularly in the housing sector.

Several underlying factors contribute to the persistent nature of rent inflation. A critical aspect is the disparity in rent increases between new and existing leases, often exacerbated by a tight housing market and rising demand. As new rental prices climb, existing tenants may find themselves facing rent hikes that have not kept pace with market rates. This lag creates significant pressure on tenants who may already be struggling to meet their current rent obligations.

Moreover, the broader economic climate, including employment trends, plays a vital role in determining the trajectory of rent prices. Notable shifts in the job market, as indicated by Boston Fed chief Susan Collins, suggest a less frenetic pace of rent increases, which could eventually translate into slower growth for rental renewals. However, until this backlog of rent inflation is addressed, tenants will continue to bear the burden, which could restrict their discretionary spending and overall economic recovery.

The report from the Federal Reserve Bank of Cleveland underscores the complexity and urgency of the rent inflation issue as it relates to the broader economic recovery. With predictions suggesting elevated rent inflation through at least 2026, the implications for consumers, policymakers, and the economy as a whole are significant.

As stakeholders seek solutions to address these challenges, understanding the underlying factors of rent inflation and its potential trajectory will be crucial. While there appears to be a slow shift towards stabilization, ongoing monitoring and strategic interventions may be necessary to ensure that the so-called “stickiest” components of inflation do not hinder the economic recovery moving forward. Ultimately, addressing these persistent issues in rental markets will be paramount in paving the way for sustainable economic growth and improved consumer welfare.