The ever-evolving landscape of the global economy is intricately tied to currency fluctuations, and the US Dollar (USD) is no exception. This analysis delves into recent movements and projections regarding the USD, particularly in light of actions taken by central banks around the world and specific economic indicators that signal potential shifts in market sentiment.

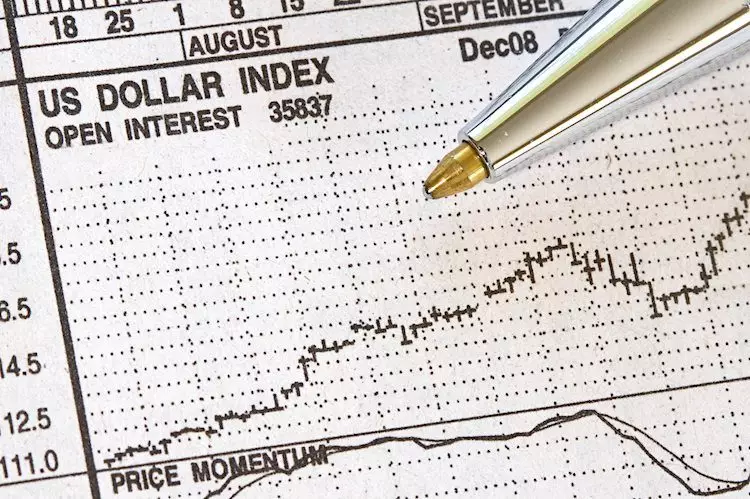

On a recent trading day, the US Dollar Index (DXY) was seen to temper its bullish stance after a notable rise earlier in the week. Traders closely monitored developments in China, where the government announced various stimulus measures and cuts to deposit rates, aiming to bolster domestic demand. Such moves typically have profound implications for currency valuations, particularly for the USD, which has often been viewed as a safe haven in times of economic uncertainty.

As the DXY hovered near the psychological barrier of 104.00, market participants were acutely aware of the various economic data releases scheduled for that day. The US Census Bureau, for instance, was set to unveil housing data that many expected would show a slight decline in both monthly building permits and housing starts. These metrics are indicators of economic health, and any deviations from expectations can lead to immediate reactions in currency markets, influencing traders’ perceptions of the USD’s strength.

In addition to scheduled data releases, significant speeches and presentations by Federal Reserve officials took center stage. Notably, Atlanta Fed President Raphael Bostic was slated to address high school students on economic education. While this may appear as a benign event, it is indicative of the Fed’s broader efforts to engage with and educate the public on monetary policy, potentially impacting future sentiment regarding interest rates. Later that day, Minneapolis Fed President Neel Kashkari was expected to moderate a policy panel, echoing the Fed’s overarching commitment to transparency.

As these officials communicate the Fed’s economic outlook, their messages can sway trader expectations concerning interest rate adjustments. The consensus among market analysts was leaning towards anticipations of rate cuts—this is significant as the CME suggested a 90.2% likelihood of a 25 basis points rate reduction in the upcoming November meeting, reflecting a marked shift in investor sentiment following recent economic crises.

Interest rate policies play a pivotal role in determining the strength of the USD. When comparing the interest rates in the US to those in the Eurozone and elsewhere, it’s clear that a widening gap places renewed support for the Dollar, at least in the short term. Should former President Trump maintain his lead in the polls, traders could witness a rapid resurgence in the USD, potentially pushing past key levels approaching 105.00.

However, the ongoing debate regarding the future of the Federal Reserve’s monetary policy raises important questions. Market adjustments in the wake of banking stability fears following the March 2023 crisis have fundamentally altered investor expectations. The fallout from the insolvency of several US banks, most notably Silicon Valley Bank and Credit Suisse, highlighted precarious elements within the banking sector, ushering in reevaluations of future interest rate trajectories. Once perceived through the lens of controlling inflation, the Fed’s policy now faces scrutiny as economic stability is wrestled back into consideration.

Interestingly, while the USD faced downward pressure in the wake of these banking crises, gold emerged as a compelling alternative investment. Gold’s appeal as a safe haven means that during periods of uncertainty, demand can surge, which further drives its price up when the Dollar weakens. This key relationship plays an essential role in shaping the behavior of both assets.

As the Federal Reserve contemplates its path forward, the anticipation around interest rates is crucial. Lower interest rates—viewed as favorable for gold—also diminish the cost of holding the precious metal, thereby contributing to its demand when investors seek stability amidst volatility.

The current state of the US Dollar is emblematic of a complex interplay between economic indicators, central bank policies, and global events. As stakeholders keep a keen eye on forthcoming data releases and speeches from pivotal figures within the Federal Reserve, they will inevitably remain alert to the broader implications these developments have on currency movements.

Navigating this landscape requires a nuanced understanding of market psychology and macroeconomic principles. As we approach critical periods, such as the upcoming US elections and critical Fed meetings, traders and investors alike will need to remain vigilant, adapting their strategies to the rapidly changing economic environment. As the USD’s journey continues, it will undoubtedly reveal insights into the resilience or vulnerability of the global financial system.