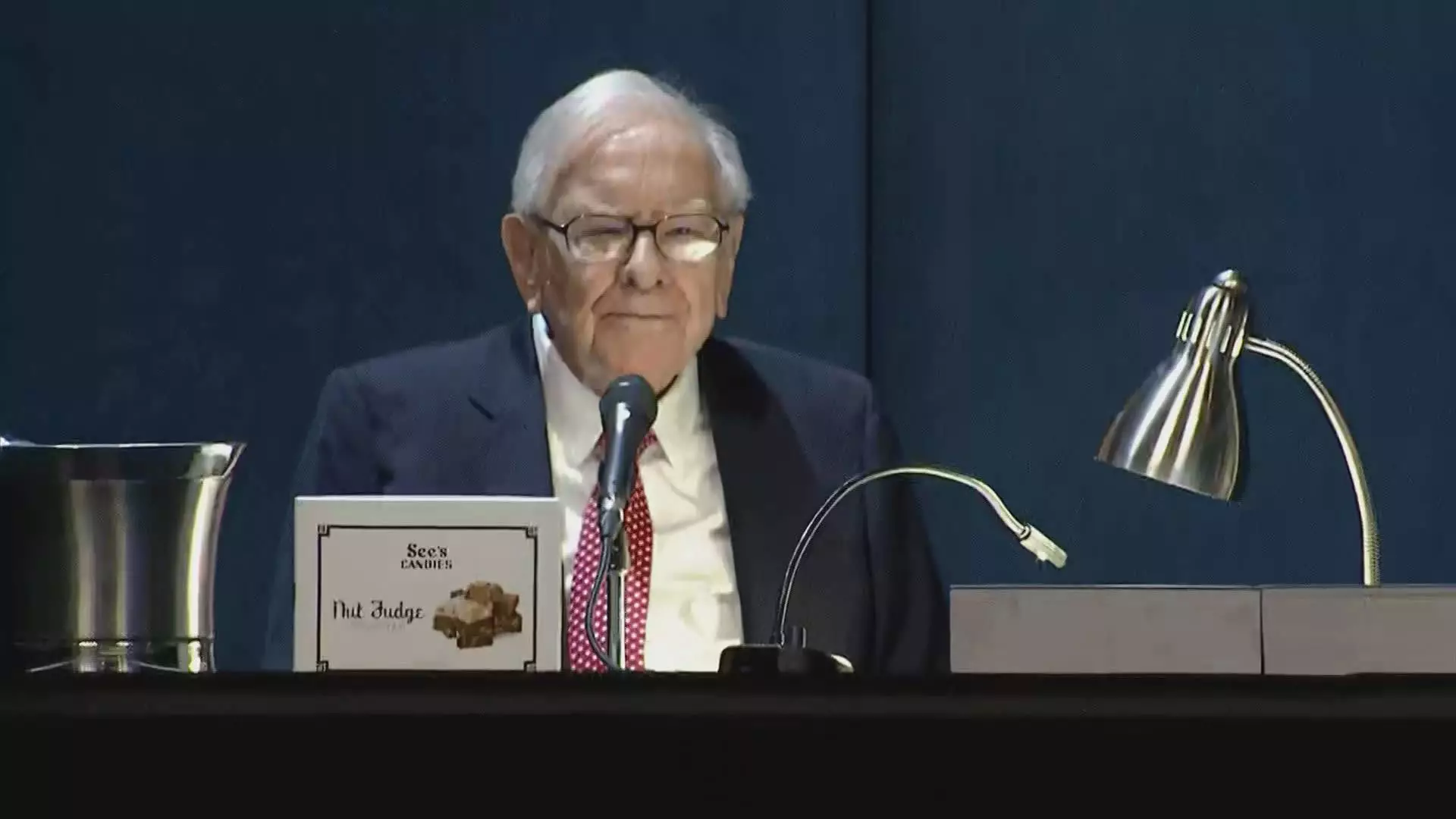

Warren Buffett, often referred to as the “Oracle of Omaha,” has continued to sell off a significant portion of his stake in Apple Inc., marking the fourth consecutive quarter of reductions. As of the end of September 2023, Berkshire Hathaway reported possessing $69.9 billion worth of Apple shares, indicating a staggering 67.2% decrease in value compared to the same period the previous year. This latest move saw Buffett dispose of about 300 million shares, suggesting he has divested approximately a quarter of his remaining stake. Such ongoing sell-offs warrant deeper scrutiny regarding Buffett’s motives and future strategies.

Despite speculation surrounding his sales strategy, the exact reasons behind Buffett’s increased divesting remain unclear. Initially, analysts believed that high valuations were a significant factor, coupled with a desire to manage portfolio concentration more effectively. At one point, Apple’s relevance to Berkshire’s total equity portfolio became overwhelmingly large, exceeding half of its entire equity holdings. Furthermore, during the annual Berkshire meeting in May, Buffett pointed to potential tax implications as a driving factor in his decision to scale back. He noted concerns about possible increases in capital gains tax in response to the government’s attempts to address the ever-growing fiscal deficit.

However, the sheer volume of shares sold has prompted speculation of more complex motivations. It raises questions about whether Buffett may be acting on a broader investment philosophy or responding to external economic pressures.

Berkshire’s history with technology investments, particularly Apple, is a fascinating aspect of Buffett’s broader investment journey. Historically, Buffett has shunned tech companies, often citing that they were outside of his “circle of competence.” Yet, the appeal of Apple proved so strong that he reversed this narrative, investing in the tech giant due to its strong customer loyalty and the brand’s profound influence on consumers. The enthusiasm demonstrated by Buffett and his investment lieutenants, Ted Weschler and Todd Combs, led to Apple becoming Berkshire’s largest holding, often described by Buffett as the second-most significant business investment after his portfolio of insurance companies.

The pivot to investing in technology marks a pivotal shift in Buffett’s strategy, showcasing a willingness to adapt and embrace new market dynamics.

As Berkshire Hathaway pursues a more balanced investment portfolio, its cash reserves have ballooned to an impressive $325.2 billion as of the third quarter. This sets an all-time high for the conglomerate and illustrates its cautious approach amidst market volatility. Interestingly, Berkshire even paused its buyback program during this quarter, signaling a more conservative financial strategy as Buffett re-evaluates his major holdings.

Despite the worrying reductions in Apple shares, it’s noteworthy that Apple stock has seen a commendable 16% rise year-to-date, albeit trailing the S&P 500’s impressive 20% gain. The juxtaposition of this data creates an intriguing narrative for investors ticking possibly towards diversification while remaining cognizant of potential market fluctuations.

Buffett’s strategic decisions, including the recent Apple stake reductions, reflect a careful consideration of changing market conditions and personal investment philosophies. The implications of these actions may redefine Berkshire Hathaway’s future trajectory, proving that even the most successful investors must adapt to the ever-evolving economic landscape.