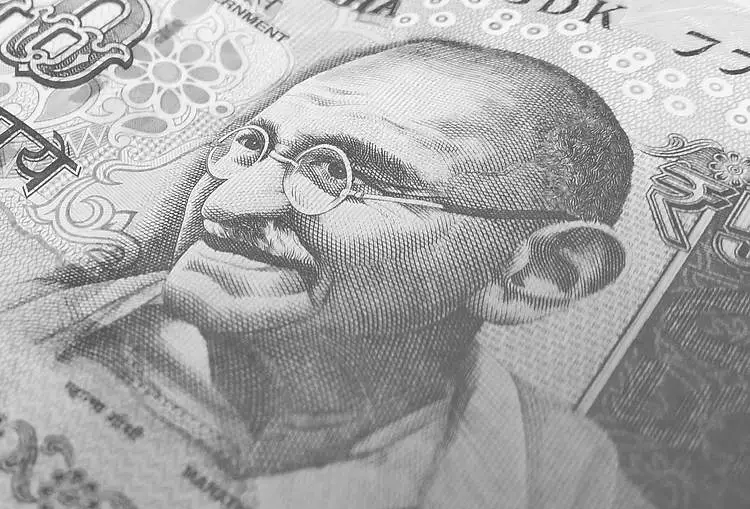

The Indian Rupee (INR) is currently experiencing downward pressure as negative market sentiments, fluctuations in crude oil prices, and changes in foreign investment trends converge to challenge its stability. This article delves into the factors affecting the INR, emerging market dynamics, and what lies ahead for this key emerging market currency.

On a recent trading day, the Indian Rupee showed signs of weakness amid a significant selloff in the domestic equity markets. With foreign investors withdrawing over $1.5 billion from Indian stocks in the current month alone, the sentiment surrounding the INR is increasingly tenuous. This follows substantial outflows of $11 billion in the preceding month, stirring concerns about investor confidence in Indian markets.

Moreover, crude oil prices are on an uptick, compounding the INR’s vulnerability. As an oil-importing nation, India’s economy is particularly sensitive to oil price hikes, which can widen the trade deficit and exacerbate inflationary pressures. With the global economic landscape being impacted by fluctuating oil prices, the sustained rise has heightened scrutiny on India’s balance of payments and future currency valuation.

In addition to local factors, international economic indicators significantly impact the INR. Recent statistics from the U.S. reveal an increase in initial jobless claims, echoing a broader slowdown in the U.S. economy. The Federal Reserve’s decision to lower benchmark interest rates to a target range of 4.50% – 4.75% has lifted hopes for further easing in December, with the likelihood of a quarter-point rate cut rising to over 68%, according to projections.

Such developments can indirectly strengthen the INR, despite the immediate challenges, as lower rates in the U.S. may make emerging markets like India more attractive due to relatively higher returns. However, the Reserve Bank of India’s (RBI) consistent intervention in forex markets remains essential for maintaining stability in light of these external pressures.

From a technical standpoint, the USD/INR pair is currently in a bullish trend, remaining above the critical 100-day Exponential Moving Average (EMA). Nevertheless, the 14-day Relative Strength Index (RSI) positions the currency in an overbought territory, typically suggesting that a period of consolidation may be necessary before any substantive movement towards a stronger INR. As traders monitor key resistance levels around 84.30 and psychological barriers at 85.00, any breach of support levels could lead to significant selling pressure.

Understanding these technical indicators is critical for investors as they navigate a market characterized by variables that can shift rapidly, including unexpected economic disclosures or geopolitical events.

Multiple macroeconomic variables influence the value of the INR, including inflation rates, interest rates, GDP growth, and foreign investment flows. India’s relative insulation from trade with China, as reported by Emkay, positions it more favorably than many of its Asian counterparts, potentially attracting foreign capital amidst growing uncertainties elsewhere.

The RBI’s monetary policy, particularly its inclination towards interest rate adjustments, fluctuates in response to mounting inflation. As inflation rates increase, the RBI may be propelled to hike interest rates, which can ultimately bolster the INR by enhancing its yield attractiveness to foreign investors. This interdependence between interest rates and currency strength underscores the complexity of monetary policy in safeguarding economic stability.

The Indian Rupee finds itself navigating a challenging landscape characterized by domestic equity selloffs, adverse crude oil price movements, and critical international economic trends. While there are potential strengths inherent in India’s economic framework and lesser dependency on specific trade partnerships, the resilience of the INR will largely hinge on proactive monetary policy responses from the RBI and its ability to foster an environment that is favorable for foreign investments.

As investors remain vigilant in these unpredictable times, maintaining an adaptive strategy that accounts for evolving macroeconomic signals while being aware of geopolitical developments will be crucial for leveraging the opportunities presented by fluctuations in the Indian Rupee’s value. The interplay of these factors will ultimately determine the future trajectory of the INR, a key barometer for assessing India’s economic health.