In recent weeks, the Swiss Franc (CHF) has gained traction against the Euro, a trend typically driven by investor anxiety concerning political instability within the Eurozone. As the European Union grapples with renewed uncertainty, particularly stemming from France, the Swiss Franc has emerged as a preferred safe-haven currency. However, this rise raises critical questions for the Swiss National Bank (SNB), particularly regarding the ramifications for Switzerland’s export-reliant economy.

The recent political upheaval in France, characterized by challenges to Prime Minister Michel Barnier from both left and right factions, has provoked investor unease. This political landscape is increasingly being viewed as a catalyst for a shift towards the Swiss Franc, which traditionally performs well during periods of instability. Analysts at Bank of America emphasize that the CHF’s role as a hedging mechanism remains pronounced as investors seek stability in uncertain times. Despite this movement, the degree to which the Swiss Franc has outperformed other currencies in the G10 is a subject of scrutiny.

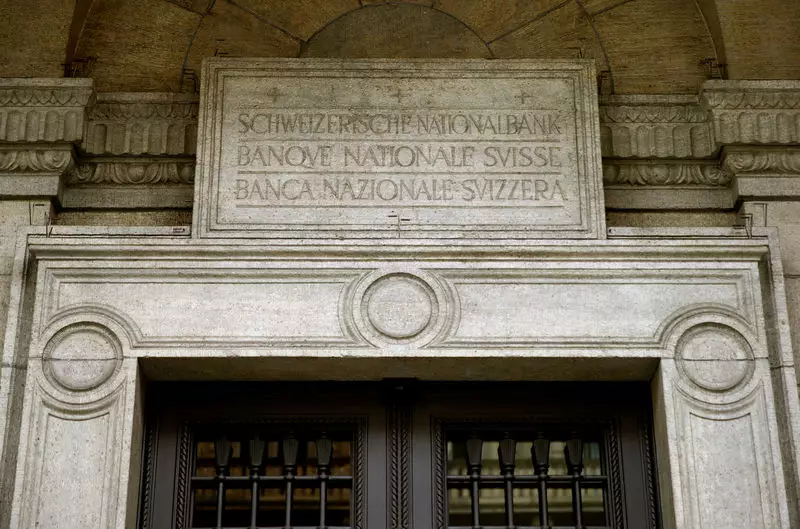

The SNB closely monitors the CHF’s exchange rate against the Euro, given Switzerland’s status as a major trading partner with the Eurozone. An overly strong Franc poses significant threats to the competitiveness of Swiss exports, potentially jeopardizing economic growth. Yet, current analysis suggests that the CHF’s appreciation against the Euro is more influenced by speculative short positions rather than a direct flight to safety. This may alleviate some of the immediate pressure on the SNB, reducing the likelihood of drastic policy interventions.

Despite the apparent safe-haven flows into the Swiss Franc, data indicates that such movements are not sufficiently robust to compel the SNB into aggressive currency intervention. Seasonal patterns also suggest that the Euro’s position may weaken further in the coming months, as historical trends show a decline in EUR/CHF during December. The overall assessment of current market dynamics indicates that the SNB is not under immediate pressure to alter its monetary stance significantly.

Looking ahead, investors may find value in exploring bearish positions against the Swiss Franc, particularly in relation to currencies such as the British Pound (GBP) and the US Dollar (USD), where clearer policy divergences exist. While the Swiss Franc will undoubtedly remain a focal point for investors seeking refuge during Eurozone volatility, the economic indicators suggest a more measured approach by the SNB in response to these developments.

While the appreciation of the Swiss Franc amid Eurozone political uncertainty captures the attention of investors, its implications for Switzerland’s economy and the SNB’s policy remain nuanced. Understanding these dynamics is crucial for navigating the evolving landscape of international currency markets. The SNB’s proactive measures, or lack thereof, will be critical in shaping the future trajectory of the Swiss Franc, as well as the overall economic health of Switzerland amidst external pressures.