The landscape of U.S. monetary policy is at a pivotal crossroads. With Jerome Powell’s tenure extending until 2026, the urgency to identify a successor signals an underlying shift in the Fed’s trajectory. Treasury Secretary Scott Bessent’s announcement about beginning the vetting process underscores an administrative desire to exert influence over monetary policy well in advance of the formal transition. This proactive stance suggests that the Biden administration perceives the importance of selecting a leader who can adeptly manage the delicate balance between inflation control and economic growth. It also reveals a strategic extension beyond routine succession planning, hinting at underlying concerns about market stability and policy direction amidst an evolving economic landscape.

The Candidate Pool: An Echo Chamber of Economics and Power

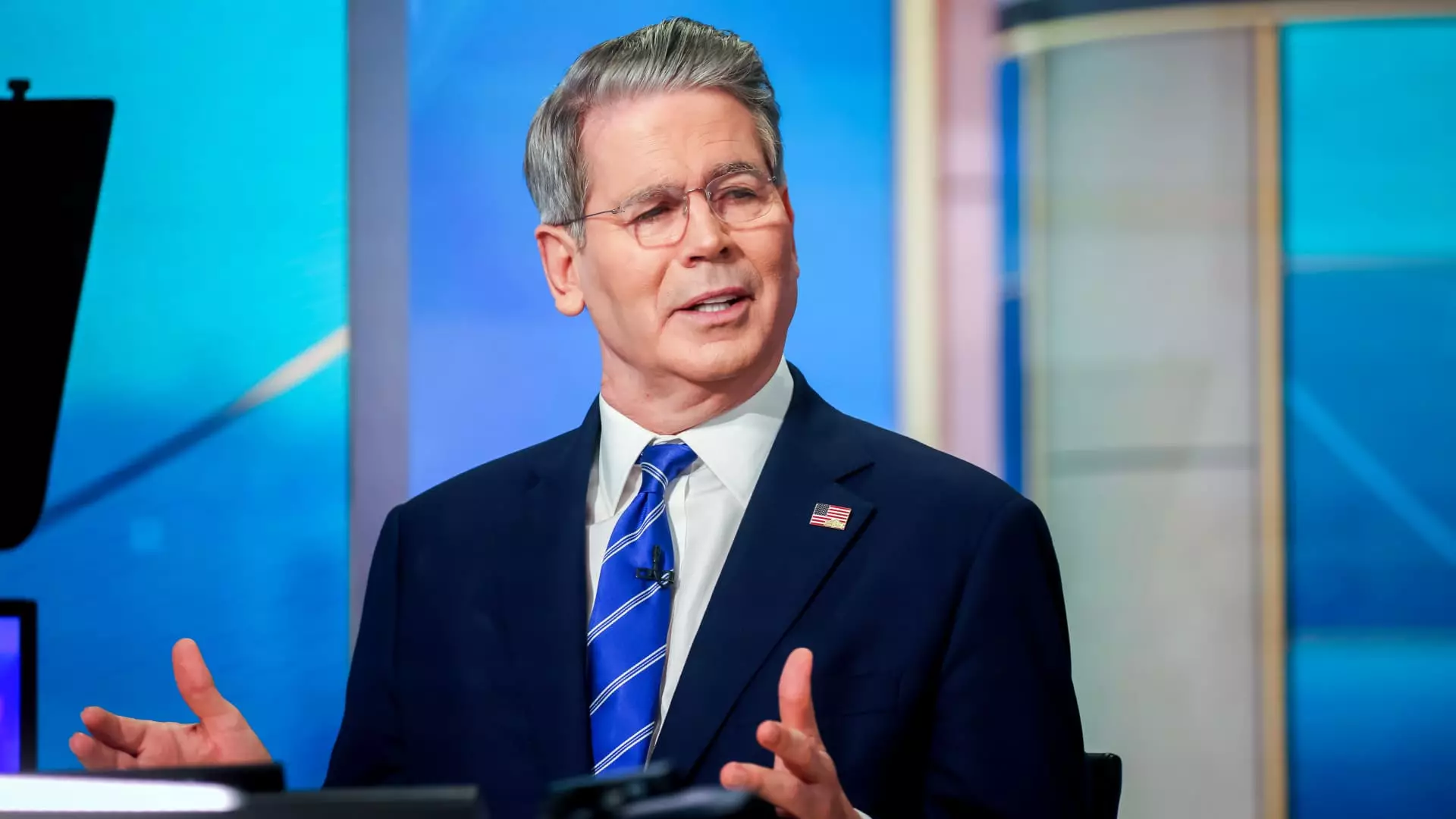

What stands out about the list of eleven candidates is not just their individual qualifications, but the mixture of backgrounds they represent. From current Federal Reserve governors to seasoned Wall Street strategists, the diversity underscores the high stakes and complex considerations involved in selection. Notably, figures such as Michelle Bowman and Christopher Waller embody institutional continuity, while outsiders like Wall Street veterans Rick Rieder and David Zervos bring market pragmatism into the mix. Their inclusion hints at a desire for a candidate who understands both the technical nuances of monetary policy and the realities faced by financial markets. The presence of prominent economists like Kevin Hassett and Larry Lindsey indicates a preference for candidates who can articulate a clear economic narrative, one that aligns with the White House’s broader policy ambitions.

The Political and Economic Imperatives: Easing or Tightening?

The White House’s push to accelerate the Fed’s leadership transition is driven, in part, by a strategic hope to influence upcoming policy decisions. Bessent’s emphasis on interest rate cuts and their potential to revive the sluggish housing sector illustrates the administration’s focus on short-term economic stimuli. This raises fundamental questions: will the new chair prioritize market stimulation through easing, or will they advocate for a more cautious, inflation-focused stance? The political calculus is apparent; a chair sympathetic to easing could smooth the path for a rapid series of rate cuts, potentially boosting economic activity but risking long-term inflationary pressures. Conversely, choosing a more hawkish figure could signal a preference for financial stability over short-term growth. Transformation in leadership at this stage could unlock or hinder the economic agenda, depending on the alignment of policy preferences.

The Timing and the Specter of Uncertainty

As the Federal Reserve prepares for its upcoming policy meeting in mid-September, the appointment of a new chair hangs in the balance. Powell’s upcoming address at Jackson Hole may be a critical moment—not just for markets, but for the direction of U.S. monetary policy. The speculation surrounding whether Powell will signal a pause or continue with rate hikes reveals the tension between monetary tightening and the potential easing that the Biden administration desires. A new chair, in this context, is not merely a symbol of leadership but a pivotal actor whose influence could redefine the trajectory of interest rates, inflation control, and economic resilience in the face of unforeseen shocks. Their initial signals at Jackson Hole could set the tone for months to come, shaping market expectations and investor confidence.

Reflections on Leadership and Power

Leadership transitions in such a critical institution should ideally be driven by expertise and a commitment to economic stability. However, the current process appears entangled with political calculations and market pressures. The combination of officials with backgrounds in government, academia, and finance illustrates a strategic attempt to balance knowledge with influence. Yet, one must question whether the process is truly meritocratic or subtly influenced by political agendas. The fact that the White House is eager to streamline the process and influence policy directions indicates an inclination toward wielding power over a complex, independent institution. This raises concerns about the independence of the Federal Reserve and whether political motives may distort a process that ideally should prioritize economic stability over short-term political gains.

Throughout this period of transition, the choice of Fed chair will reflect more than a preference for economic policies; it will be a statement about the values guiding U.S. economic policy—whether toward rapid recovery, controlled stability, or a cautious balancing act. The stakes are immense, and the trajectory set now will reverberate through markets, housing, employment, and inflation for years to come.