The shift in the global economic landscape has sparked varying concerns, with many nations showing signs of easing inflation. However, lurking within the economic developments is a troubling prospective deflation in China, the world’s second-largest economy. Recent financial indicators depict a nuanced picture where increasing consumer prices, primarily driven by transient factors, do not quell the apprehension regarding sustainable demand. This article delves into China’s current economic conditions, the implications of potential deflation, and its ripple effects on the global economy.

Understanding the Current Inflation Situation

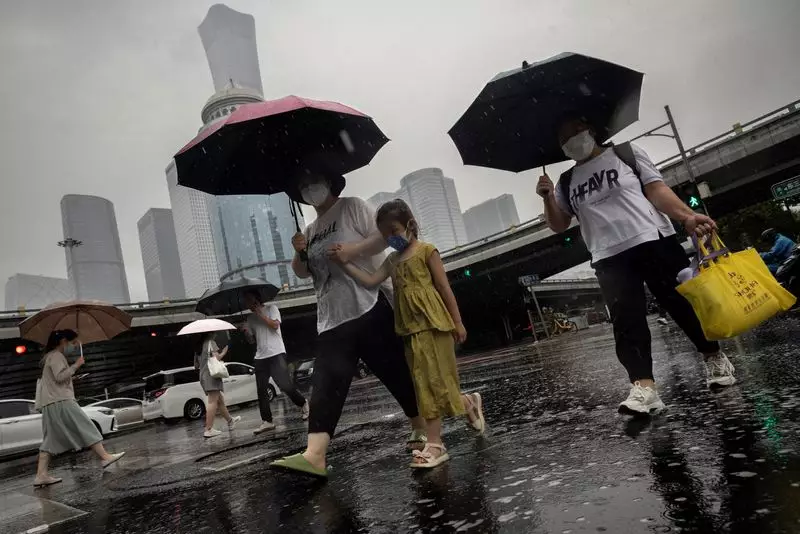

In August, China’s consumer price index (CPI) surprised analysts by indicating a year-over-year increase of 0.6%. However, this figure deserves scrutiny beyond surface-level observations. The augmented CPI largely stemmed from hikes in food prices due predominantly to adverse weather conditions during the summer months. These short-term fluctuations rather than persistent consumer demand raise alarms about the underlying economic health. A deeper dive into core consumer inflation reveals a deceleration to 0.3%, marking the lowest rate seen in over three years. This contrasting trend underscores an alarming potential for sustained deflation, inviting critical examination of the demand dynamics in China.

Deflation occurs when the price levels of goods and services consistently decline, which can reflect weak consumer demand or an oversupply of goods in the market. Historically, Japan’s two decades of economic decline, often referred to as the “lost decades,” exemplifies the grim cycle that deflation can initiate. Morgan Stanley analysts underscore that deflation in China could mark the commencement of a measurable drop in disposable income, leading to reduced spending—a dangerous cycle that could stifle economic recovery. The historical parallels serve as a cautionary tale, presenting a scenario in which decreasing consumer prices lead to diminished corporate profits, resulting in job cuts and an overall contraction in economic activity.

In the face of these emerging deflationary pressures, analysts suggest that significant government intervention may be necessary to reverse this trend. China’s government has already initiated some stimulus measures, particularly by directing loans to the industrial sector. However, the augmentation of supply without a simultaneous awakening of consumer demand has exacerbated deflation, posing challenges to overall economic vitality. Despite ambitious goals of achieving a 5% GDP growth rate for 2024, the current economic indicators cast shadows on the feasibility of these targets.

The Morgan Stanley analysts offer insights into potential fiscal responses, suggesting that a reevaluation of support systems—particularly focusing on housing and social welfare—may be essential to strengthen the real estate sector and promote aggregate savings. Nevertheless, they express skepticism regarding any substantial shift in policy direction in the immediate future, reflecting the complexities surrounding China’s intricate economic situation.

Global Implications of China’s Deflation

China’s deflationary cycle does not solely impact its domestic economy; it sends ripples across the world, impacting major economies like the US and the Eurozone. The repercussions of China’s decreasing price levels have already dented core inflation in these regions, with estimates suggesting an influence of approximately 0.1 percentage points. As central banks in the US and Europe gear up for new rounds of interest rate reductions, the interconnectedness of global economies raises crucial questions about monetary policies and economic strategies moving forward.

China stands at a critical juncture where the specter of deflation looms large, posing risks not only to its economic recovery but also to the broader global market. The multifaceted challenges presented underscore the importance of vigilant monitoring and adaptation in economic policy, both within China and globally. Historical examples serve as reminders of the potential pathways that such economic phenomena can trigger. As the world watches closely, the strategies deployed by the Chinese government and their efficacy will shape not only the future of the Chinese economy but also the broader contours of international economic stability. The need for adaptable policy approaches has never been more crucial as the landscape continues to evolve.