As we move into 2025, the Asian stock markets are exhibiting signs of resilience, navigating through the aftermath of a rocky year-end. The sentiment among investors has shown a mix of optimism and concern, particularly influenced by various geopolitical factors and shifting monetary policies. Asian indices are attempting to recover from a rather lackluster commencement to the year but remain under pressure from a strong U.S. dollar and apprehensions about prevailing U.S. interest rates.

On a positive note, the MSCI Asia-Pacific index, excluding Japan, experienced a modest increase of 0.33%. However, it is on track to close the week nearly 1% down, suggesting a turbulent trading atmosphere. This follows an impressive rise of approximately 8% throughout 2024. Japanese markets, meanwhile, are closed for the week, which may further influence trading decisions in the broader Asian context.

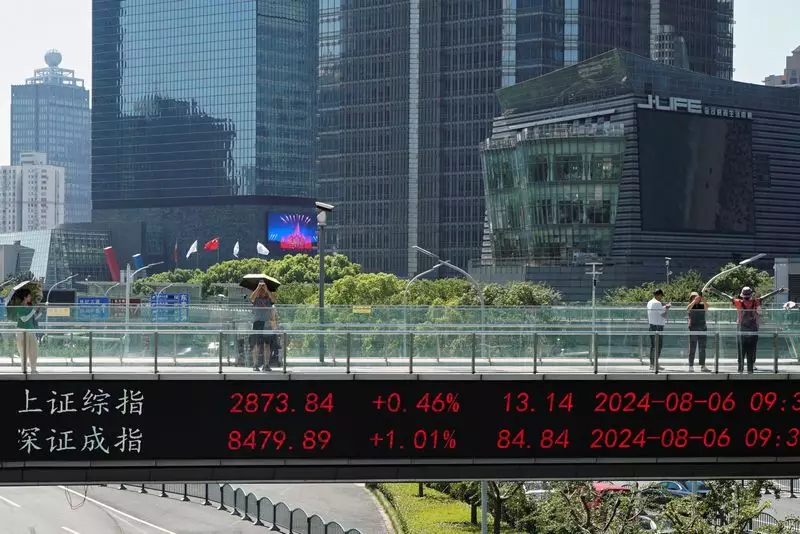

China’s stock market has been a focal point, reflecting both stability and volatility. After suffering significant losses recently, the blue-chip CSI 300 Index managed to reclaim some points, climbing by 0.16%. This bounce back may indicate investor attempts to capitalize on potential recovery. However, the overall landscape remains overshadowed by the specter of a faltering economy and other ongoing uncertainties, including the potential resurrection of trade tensions with the incoming U.S. administration.

The overarching influence of U.S. economic policies on Asian markets cannot be overstated. Following a series of dreary trading performances, U.S. equities closed lower, predominantly influenced by disappointing results from heavyweight companies like Tesla, whose shares plummeted by 6.1%. Analysts are increasingly expressing concern regarding a potential economic slowdown after a year characterized by speculative growth and inflated expectations tied to artificial intelligence and deregulatory practices under Donald Trump.

Vasu Menon, managing director of investment strategy at OCBC, presents a sobering outlook, suggesting that while Trump’s policies might be advantageous for the U.S. economy, they could impose significant challenges internationally. Higher tariffs and the strengthening of the dollar could adversely affect global trade dynamics, fostering a cautious trading atmosphere in Asian markets.

The Dollar’s Resilence: Implications for Global Trade

As U.S. interest rates remain stagnant or potentially poised for increases, the dollar has maintained its position near a two-year high. Analysts are reportedly cautious about how long this trend might endure, particularly in light of the Federal Reserve’s last-minute projections lowering their anticipated rate cuts. The dollar index stands at around 109.2, demonstrating a notable increase of 7% throughout 2024, a clear reflection of traders realigning their expectations of monetary policy.

The euro, on the other hand, has suffered significantly against the dollar, hitting a more than two-year low. This depreciation places additional strain on Eurozone economies and compounds investor sentiment about international trading prospects. The situation reflects broader trends in currency stability and the ramifications these can have on trade.

Gold and Oil: Steadiness Amidst Economic Turmoil

Despite stock market fluctuations, the commodities sector remains relatively stable, particularly in gold and crude oil prices. Gold has seen a resurgence, maintaining prices at $2,658 per ounce after a remarkable annual gain of 27% in 2024. Such resilience in precious metals often serves as a refuge for investors amid volatile market settings.

Oil prices have also nudged upwards, driven by renewed optimism regarding Chinese economic recovery initiatives after President Xi Jinping’s pledge to stimulate growth. Brent and West Texas Intermediate crude saw slight gains, further indicating a positive outlook dependent on China’s fuel demand recovery.

Asian stocks are demonstrating an ability to rebound amidst external pressures, attempting to navigate a complex interplay of U.S. economic health, fluctuating currencies, and shifting investor sentiments. While optimism prevails in certain respects, a cautious approach is warranted as global markets react to shifting monetary policies and socio-economic indicators. Investors will need to remain vigilant in the months ahead, keeping a keen eye on pertinent economic data and geopolitical developments as we advance into an unpredictable 2025.