Asian share markets displayed slight gains in a trade environment characterized by diminished activity, largely due to holiday-related reductions in trading volumes. This incremental uptick extended prior week’s movements amidst a backdrop of scarce impactful news or data that might change market trajectories. Traders are primarily concentrating on the Federal Reserve’s interest rate strategies as they consider their next moves. With major markets in Hong Kong, Australia, and New Zealand shuttered for holidays, the overall sentiment remained cautious yet moderately optimistic.

Alongside these observations, the U.S. dollar, which has been experiencing a resurgence, is currently holding close to a two-year high. The Fed’s recent meetings and pronouncements, especially those made by Chair Jerome Powell, have indicated a more conservative outlook regarding rate cuts in the approaching year. Consequently, market participants are recalibrating their expectations, now projecting approximately 35 basis points of easing by the end of 2025.

The Fed’s communication of a ‘hawkish cut’ in December has led many analysts to believe that they will hold off on making any cuts during January’s Federal Open Market Committee (FOMC) meeting. As economists like Tom Porcelli from PGIM Fixed Income suggest, the Fed will likely await further data to assess whether to continue or conclude this cycle of rate reductions. This shift towards a less accommodative monetary stance may compel the markets to closely monitor economic indicators in the upcoming year.

With this backdrop, U.S. Treasury yields have seen an uptick, reinforcing the dollar’s position, which poses challenges for commodities, including precious metals like gold. The yields on benchmark 10-year Treasury notes have been notably stable at around 4.5967%, reaching above 4.6% for the first time since late May. This rise, which has amounted to roughly 40 basis points within the month, reinforces strength in the dollar against a basket of additional currencies.

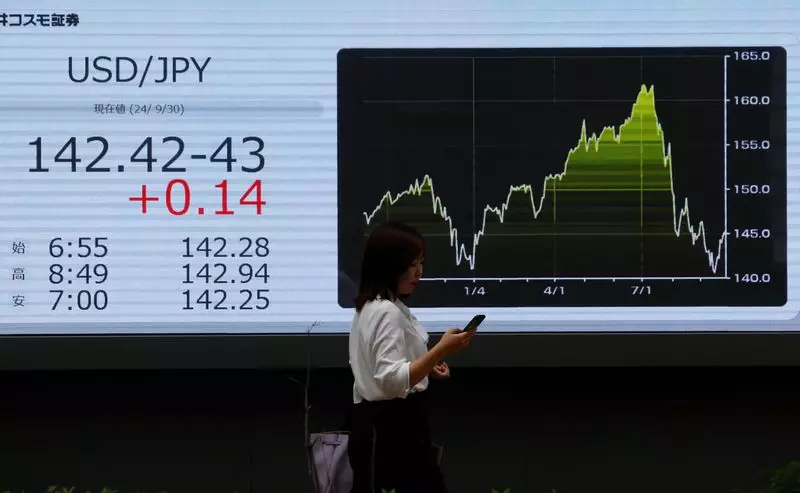

The preference for the dollar is evident as it sits at a significant position against currencies such as the Australian and New Zealand dollars, which have witnessed declines of 0.45% and 0.51% respectively. This trend reflects broader market sentiment influenced by expectations of the Federal Reserve’s monetary policy direction. The euro also experienced slight depreciation against the dollar, while the Japanese yen languished near a five-month low.

Japan’s fiscal situation is of concern, as the government prepares a record-setting budget of approximately $735 billion for the upcoming fiscal year. This necessity arises primarily from mounting social security obligations and the weight of existing debt commitments. Such systemic issues contribute to existing anxieties regarding Japan’s financial sustainability, amidst an evolving global economic landscape.

Despite the mixed signals in different regions, broad indices within Asia-Pacific were marginally upbeat. The MSCI Asia-Pacific index outside of Japan recorded a minimal rise of 0.04%, hinting at a potential overall weekly advance of almost 2%. Following cues from Wall Street, the S&P 500 futures noted a slight increase, while the Nasdaq similarly edged higher.

Interestingly, world stock markets are poised to close out the year on a high note, showing resilience in the face of geopolitical uncertainties and macroeconomic challenges. With significant contributions from the U.S. markets, largely fueled by compelling developments in artificial intelligence and robust economic performance, a general global optimism remains apparent. Analysts express mixed perceptions of market exuberance, with some noting that the optimistic U.S. stance has not necessarily undermined confidence elsewhere.

The Nikkei index in Japan recorded a commendable 0.38% increase, reflecting an expected yearly gain of over 17%. However, Chinese indices, including the CSI300 and Shanghai Composite, saw slight declines even as they maintained prospects of annual gains exceeding 10%, bolstered by governmental support measures aimed at reviving economic vitality.

Cryptocurrency and Commodities in Focus

In the realm of cryptocurrency, Bitcoin has been performing positively despite fluctuations, recently circling around a value of $98,967 after retreating from its peak just above $100,000. Changes in regulatory frameworks enabling Russian entities to utilize Bitcoin for international transactions reflect shifting perceptions of cryptocurrency as traditional systems face constraints.

In terms of commodities, Brent crude showcased minor gains hitting $73.71 per barrel, while U.S. crude managed to increase slightly to $70.25. Gold prices, a traditional safe-haven asset, experienced a modest uptick reaching $2,626.36 an ounce, aligning with the evolving landscape of market dynamics amidst the backdrop of fluctuating currencies and global economic challenges.

Overall, as traders navigate the latter part of the year amidst shifting monetary policies and varying market performances, the interplay between currency strength and commodity values will be pivotal in shaping investment strategies going forward.