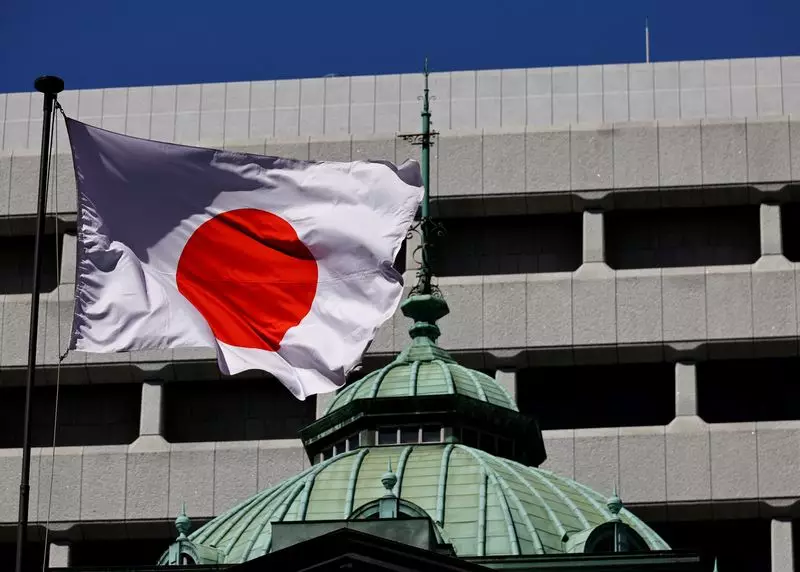

As the economic landscape continues to evolve, the Bank of Japan (BOJ) finds itself at a critical juncture regarding interest rate policy. Recent discussions among policymakers reveal a mix of caution and optimism regarding potential rate hikes in the near future. With a delicate balancing act between maintaining economic stability and addressing inflation concerns, the BOJ’s decision-making process warrants careful examination.

The October policy meeting of the BOJ highlighted the divisions within the nine-member board concerning the timing of potential interest rate increases. On one hand, some members expressed concerns about market volatility and the unpredictability of currency fluctuations, particularly concerning the yen. This echoes a broader sentiment that while the possibility for raising rates exists, the implications of such a move should not be taken lightly.

Notably, one member cautioned that it was premature to assume that markets had stabilized, emphasizing that the BOJ would need to closely observe market developments. This alertness reflects an understanding of the delicate interconnectedness between Japan’s economy and global financial markets, particularly given the recent uncertainty surrounding the U.S. economy.

The backdrop against which these discussions take place is one of gradual recovery from the pandemic’s economic fallout. With inflation rates showing signs of increasing, some BOJ members argue that the Japanese economy may no longer require extensive monetary support. This sentiment suggests a fundamental shift in economic conditions that could warrant a reassessment of the current ultra-low interest rate environment.

However, the risks that accompany a hasty tightening of monetary policy are significant. Given the historical volatility associated with financial markets, any abrupt move could trigger instability, which the BOJ is keen to avoid. The balancing act involves considering not just internal economic indicators, but also external pressures, particularly from the U.S., where a potential slowdown could have ripple effects on Japan’s recovery trajectory.

Despite the challenges, there is a consensus among certain board members about the importance of clear communication regarding the BOJ’s intentions. Articulating a commitment to increasing rates—albeit cautiously—could help anchor market expectations and prevent unnecessary panic.

Several members emphasized the need for the BOJ to signal its readiness to act if economic and price conditions align favorably. This foresight could provide a framework for navigating upcoming policy decisions while ensuring that Japan remains on a stable economic path.

The Bank of Japan faces a complex landscape as it contemplates the future of its interest rate policy. With a divided board and an awareness of the potential ramifications of their decisions, the importance of ongoing market analysis cannot be overstated. The BOJ’s cautious yet strategic approach reflects an ongoing commitment to fostering economic stability while remaining adaptable to changing global dynamics. As policymakers continue to assess the situation, the need for sober judgment and clear communication will be paramount in navigating an uncertain economic future.