The landscape of consumer financial protection in the United States is facing unprecedented turbulence, primarily stemming from a strategic shift within the Consumer Financial Protection Bureau (CFPB). Recently, a series of communications have emerged from the CFPB leadership that highlights a potential restructuring and a shift in priorities that could significantly impact both consumers and the agency’s workforce.

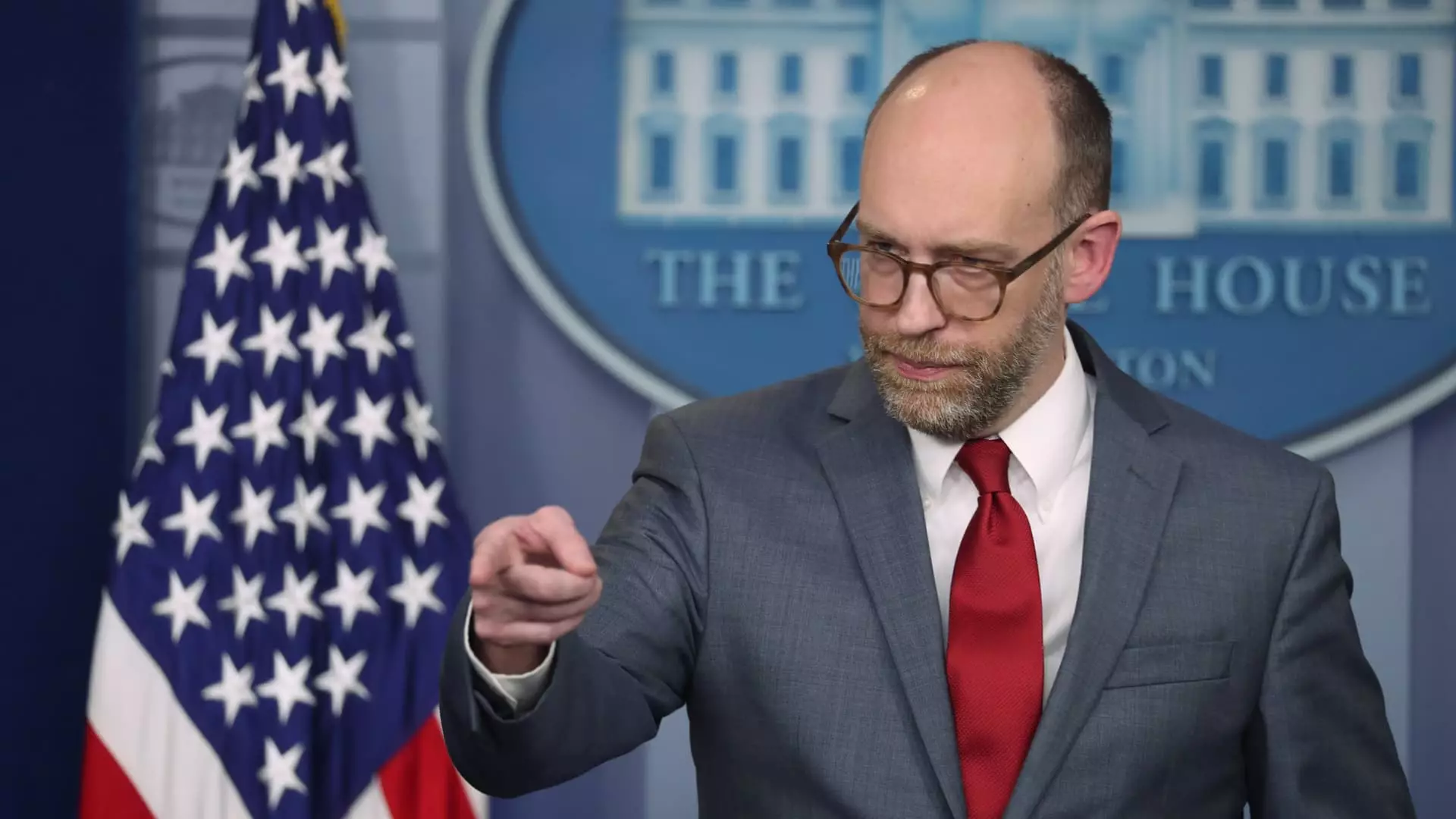

In a notable directive issued by CFPB Chief Operating Officer Adam Martinez, employees have been advised to transition to remote work until February 14, due to an abrupt closure of the agency’s Washington, D.C., headquarters. This announcement follows a memorandum from newly appointed acting director Russell Vought, which called for the suspension of nearly all regulatory activities. Vought’s directive essentially places a halt on monitoring and supervising financial institutions, raising alarms among CFPB staff and external observers about the agency’s capacity to carry out its foundational mission.

A concerning aspect of this narrative is the creeping influence of external actors, particularly employees associated with Elon Musk’s DOGE operations, who reportedly gained unwarranted access to critical CFPB data. These developments beg the question: What is the future of an organization meant to protect consumers when its internal processes are compromised? This infiltration, coupled with the chaotic operational directive, raises significant concerns about the stability and integrity of the CFPB’s mission.

Vought’s financial freeze, which he publicly announced via social media, signifies a strategic move against what he calls “the unaccountability” of the CFPB. This signal to cut off funding not only shares ominous implications for the future operations of the bureau but also reflects a broader political maneuvering aimed at weakening an agency long criticized by financial sectors. Critics of the CFPB have continuously posited that it exhibits overreach, and the current structural changes threaten to strip the agency of its operational capabilities, potentially undermining the consumer protections that the bureau was designed to ensure.

The real concern here is the potential impact on the CFPB’s core functions, particularly those designed to shield consumers from predatory financial practices. Many recent initiatives aimed at regulating abusive credit card fees and eradicating excessive overdraft charges stand at risk amid this looming austerity, jeopardizing the financial well-being of millions of Americans.

Staff Morale and Employment Anxiety

As the CFPB restructures, employee anxiety about job security grows considerably. With approximately 1,700 personnel, a staggering number of staff members face the unsettling prospect of layoffs or administrative leave, reminiscent of purges experienced in other federal agencies under the previous administration. Sources within the bureau indicate that this has resulting in a climate of fear and uncertainty; employees are questioning their future within an organization that has seen its foundational support overtly challenged.

Notably, while only a fraction of the CFPB’s roles are mandated by law, mass layoffs would create a domino effect, crippling the agency’s capacity to conduct essential oversight of the financial system—an outcome specifically counter to its establishment following the 2008 financial crisis. With consumer protection hanging in the balance, the staff increasingly fears that their efforts to hold financial institutions accountable may be severely compromised.

The current trajectory raises significant concerns not just for CFPB employees but for American consumers at large. The agency’s role has equipped it to guard against exploitation by banks and financial firms, but this recent upheaval threatens to destabilize longstanding efforts to implement fair consumer practices. If Vought’s measures lead to significant reductions in the agency’s capabilities, protections put in place for consumers could erode, leaving many vulnerable to predatory financial behaviors once more.

As this situation unfolds, all eyes will be on the CFPB and its capacity to navigate these tumultuous waters. The questions surrounding its future are manifold: Will the agency be able to retain its workforce? How will consumers fare in the absence of vigilant oversight? The answers to these queries will be paramount in determining the trajectory of consumer financial protection over the coming years. The political and operational realities faced by the CFPB will necessitate close examination, as the ramifications of these changes are felt across the nation.