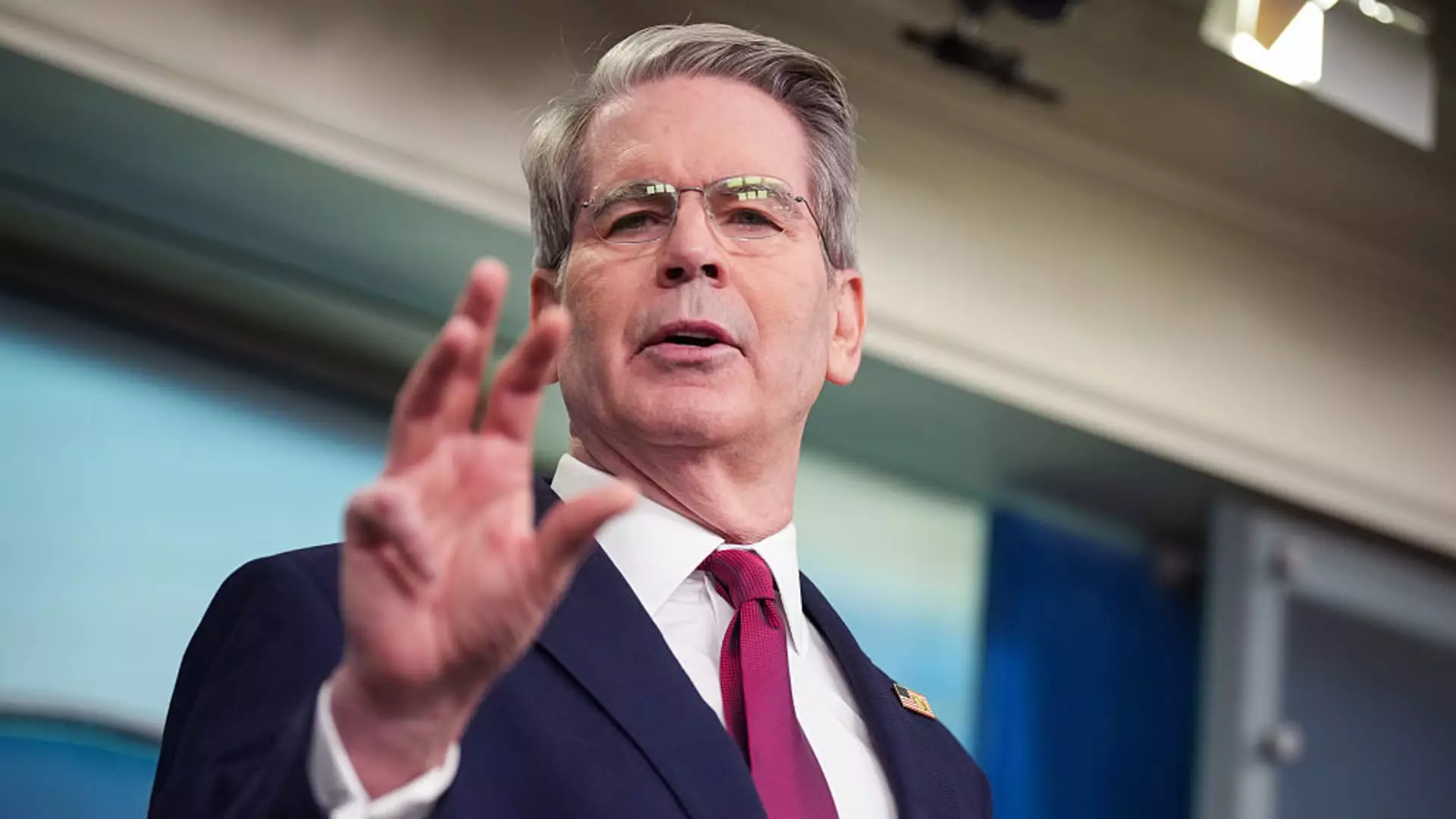

In a time of heightened market uncertainty, characterized by dramatic fluctuations and economic forecasts that swing like a pendulum, the performance of individual investors reveals an intriguing narrative. Treasury Secretary Scott Bessent recently pointed out that while institutional investors seem to be caught in a panic-driven whirlwind, individual investors appear to hold steadfastly to their positions, championing President Donald Trump’s tariff policy. This unwavering confidence poses a fundamental question: what makes the average investor more resilient than hedge funds and financial powerhouses?

Bessent noted a striking statistic from Vanguard, stating that an astonishing 97% of individual investors have refrained from trading within the last 100 days. This trend suggests that many retail investors have adopted a long-term perspective, refusing to succumb to the market’s temptations or disruptions. The idea that a significant portion of the population trusts Trump’s economic strategies, even amidst a noisy political climate, reflects a belief that the current hardships are transient and that the economic fundamentals will eventually prevail.

The Impact of Tariff Policy

However, the aggressive tariff policies initiated by Trump have induced a ripple effect, causing the S&P 500 to experience one of its most severe sell-offs since the pandemic began. Initially, the market tumbled into bear territory, but the rapid recovery the index has encountered calls into question the sustainability of this rebound. Are retail investors not aware of the potential consequences of these tariffs? Or are they simply ignoring them, convinced that their patience will be rewarded?

As institutional investors and hedge funds scramble to hedge against perceived risks in an economic landscape riddled with uncertainty, it’s evident that their fear diverges sharply from retail investors’ optimism. The continuous push for tariffs has raised alarm bells about its impact on consumer spending and overall economic health, leading analysts like Torsten Slok to predict a looming recession. The absence of trade with major partners is projected to yield shortages that could adversely affect retailers and, ultimately, consumers.

Institutional Concerns vs. Retail Confidence

Ken Griffin, the CEO of Citadel, articulates a valid concern regarding the long-term image of the United States in global markets. The trading environment is nuanced: while retail investors continue to express confidence, institutional players, who often rely heavily on data and responsive strategies, are leaning toward pessimistic forecasts. Their wariness stems from actual market behavior, compounded by political rhetoric that could complicate the attractiveness of U.S. Treasury debt.

It is essential to dissect the divergence in sentiment. Retail investors may not have the same access to analytical resources as institutional players, yet their collective tendency to “buy the dip” signifies a distinct connection to the market that transcends mere numbers. This psychological resilience is paramount, particularly as they face the possibility of economic challenges ahead.

What this dichotomy highlights is more than just confidence in a leader’s strategy. It exposes the philosophical divide between long-term investors willing to weather the storm and those preferring to play it safe in uncertain waters. In a market inherently shaped by sentiment, it will be illuminating to see which camp ultimately prevails as the dust settles over recent tariff-induced chaos. Is it possible that what lies ahead could redefine the relationship between individual investors and institutional dynamics forever?