In quantitative trading, identifying anomalies in price movements can help uncover profitable opportunities, or alpha, that are not explained by the market. One powerful technique for this is Z-score-based anomaly detection, which highlights extreme deviations from a rolling mean.

In this article, we demonstrate a strategy that detects these anomalies and evaluates whether exploiting them can produce alpha.

Detecting Anomalies with Z-Score

The first step is calculating the rolling Z-score over the closing prices. This allows us to quantify how far a value deviates from its recent history:

df[‘rolling_mean’] = df[‘Close’].rolling(window=200).mean()

df[‘rolling_std’] = df[‘Close’].rolling(window=200).std()

df[‘zscore’] = (df[‘Close’] – df[‘rolling_mean’]) / df[‘rolling_std’]

Here, any significant deviation above or below a threshold is considered an anomaly. These anomalies are then flagged as potential reversal signals.

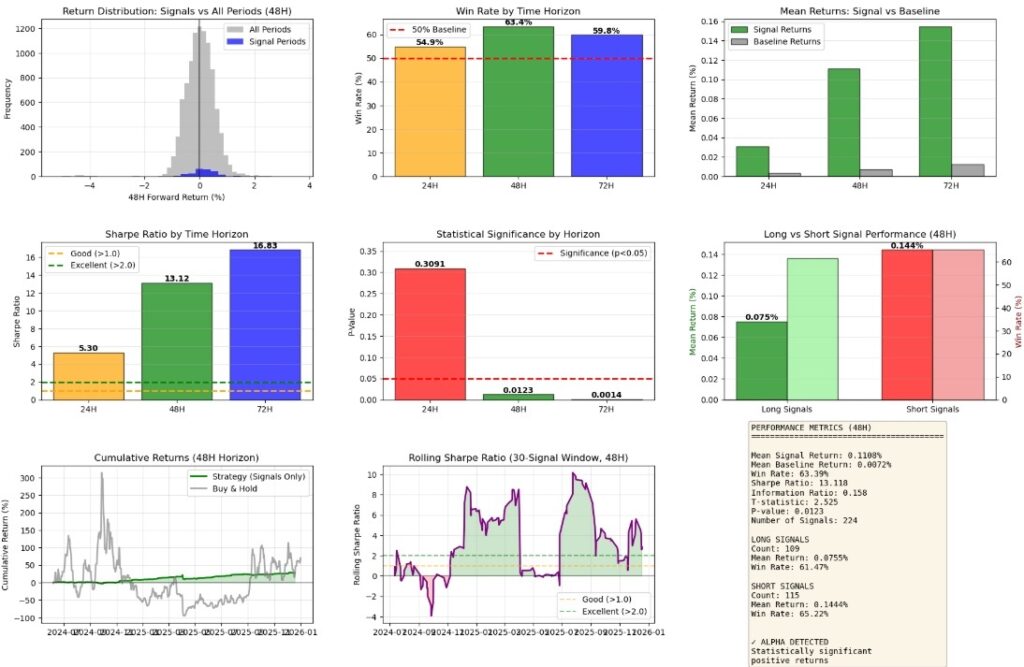

Generating Signals and Measuring Forward Returns

Once anomalies are detected, we define long and short signals based on threshold crossings. Forward returns are calculated to see if acting on these signals produces positive outcomes:

df[‘long_signal’] = ((df[‘zscore’].shift(1) < -2) & (df[‘zscore’] >= -2)).astype(int)

df[‘short_signal’] = ((df[‘zscore’].shift(1) > 2) & (df[‘zscore’] <= 2)).astype(int)

df[‘signal’] = df[‘long_signal’] – df[‘short_signal’]

df[‘signal_return_48h’] = df[‘signal’] * (df[‘Close’].shift(-48) – df[‘Close’]) / df[‘Close’]

This approach allows us to evaluate the alpha generated by exploiting statistical anomalies in the data.

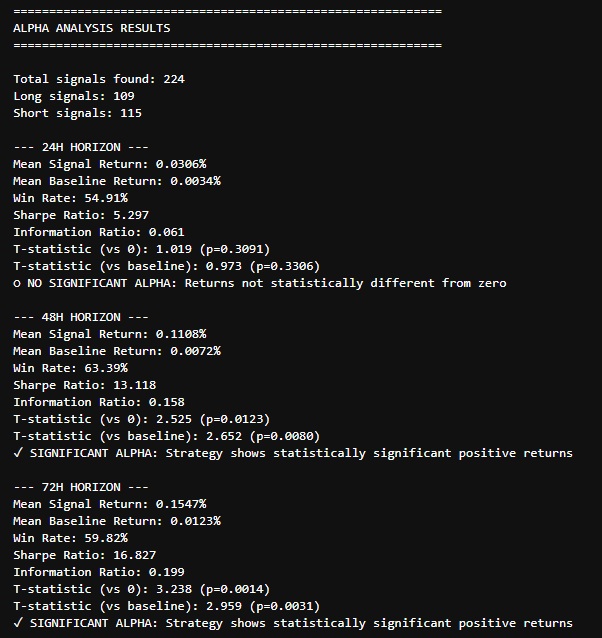

Testing Alpha In-Sample vs Out-of-Sample

To avoid overfitting, it’s crucial to separate the data into in-sample (training) and out-of-sample (testing) periods. The strategy is evaluated on both to determine its robustness:

split_idx = int(len(df) * 0.7)

df_in = df.iloc[:split_idx] # In-sample

df_out = df.iloc[split_idx:] # Out-of-sample

results_in = test_alpha(df_in)

results_out = test_alpha(df_out) By comparing cumulative returns, win rates, and Sharpe ratios across these periods, we can assess whether the anomalies truly provide alpha or are just random noise.

Key Takeaways

- Anomaly Detection via Z-score is a simple yet powerful method to identify extreme deviations in time series data.

- Signal-based alpha testing helps quantify if exploiting these anomalies generates statistically significant returns.

- In-sample vs Out-of-sample analysis is critical to ensure the strategy’s robustness and avoid overfitting.

Using these methods, quantitative analysts can systematically uncover anomalies in markets and evaluate strategies that may generate alpha.

Another essential reason to switch to solar power may be the cost savings it gives. Solar power panels are capable of generating electricity for businesses, reducing or eliminating the need for traditional sources of energy. This may end in significant savings on energy bills, especially in areas with a high energy costs. Furthermore, there are many different government incentives and tax credits open to companies that adopt solar technology, which makes it a lot more cost-effective and affordable.

The technology behind solar technology is not at all hard, yet highly effective. Solar energy panels are made of photovoltaic (PV) cells, which convert sunlight into electricity. This electricity are able to be stored in batteries or fed straight into the electrical grid, with regards to the specific system design. To be able to maximize the advantages of solar power, you will need to design a custom system this is certainly tailored to your unique energy needs and requirements. This may make certain you have the best components in position, such as the appropriate number of solar panel systems therefore the right form of batteries, to maximise your time efficiency and value savings.

[url=https://www.whartonfintech.org/our-team]Matt D’Agati’s position in bella city renewable power programs.[/url]

[url=https://kitchengrande.com/commercial-burger-grill/#comment-317204]Understanding Sun-powered Power Potential in Seas[/url] c41_069

“Carnal temptress demands irresistible passion.” Here — Kj3fz2f.short.gy/ueeSek?Nax

This isn’t random. This game pays action. Yours? Spin to Win Here -> u.to/Od47Ig

https://chem696.asia/ chem696 new

Привет всем! Стоит заранее разобрать — проблемы с крышей МКД. Суть в том, что: управляющая компания тянет — пора звать специалистов. Для вашего ТСЖ: [url=https://montazh-membrannoj-krovli-spb.ru]https://montazh-membrannoj-krovli-spb.ru[/url]. На практике крыши многоэтажек — давно требуют замены. В общем ремонтировать рубероид смысла нет — значит пора ставить мембрану. Общие рекомендации: провести собрание. Вместо заключения: удаётся достигать классных результатов — жители довольны.